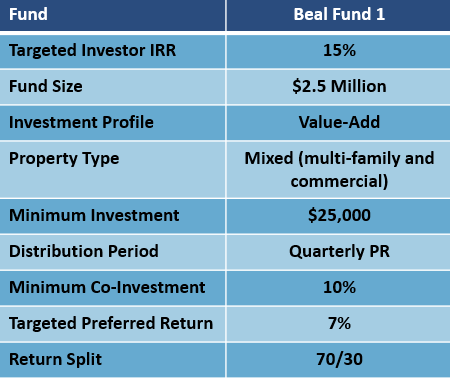

|

Beal Fund 1 LP, a Delaware limited partnership, has been formed to invest in workforce multi-family and commercial real estate assets in Michigan and Ohio. The fund will focus primarily on moderate-to-low income housing in areas with strong employment in stable fields.

Beal Capital will create value by implementing capital improvements plans, creating operation efficiencies, increasing occupancy, and reducing operational expenses. The portfolio is expected to benefit greatly from economies of scale through aggregation. |

ottawa park - Toledo, OH

This investment includes 25 total units at 2239 Upton, 2270 Torrey Hill, 2274 Torrey Hill, 1938 Macomber and 1944 Macomber in Toledo, OH. Beal Properties has managed these properties for over a year. Ottawa Park is a desirable location in the medical and university core of the city - meaning it is always in high demand.

WASHINGTON ARMS - MONROE, MI

Washington Arms boasts an attractive mix of one and two bedroom apartments for a total of 60 units. Combined with a supply deficit in Monroe’s apartment market, Washington Arms’ above average-sized apartments means maintaining occupancy near or at 100 percent. The City of Monroe has a classic Midwestern small-town charm and serves as a commuter city, a mid-point between Detroit and Toledo. The Beal Team has been managing this property for two years.

ashland - toledo, oh

Beal Capital has closed on the Ashland deal - and several value-added improvements have already been completed. The Ashland property consists of four historic homes on one parcel in Toledo, OH. It is located just two blocks from our management office in Toledo’s historic Old West End. Ashland features 14 apartments - and we already manage 1,800 apartments throughout Toledo with a reliable team and a strong network in the city.

dundee portfolio - dundee, mi

The Dundee portfolio is a package of three beautiful buildings along the Dundee River in Dundee, MI. The portfolio features 34 apartments and three in-demand commercial spaces. We have a unique advantage on this deal given that we have been managing these properties for over a year - overseeing significant improvements and capital expenditures during that time. Our strategy is to minimize turnover costs while increasing rents through our existing relationships with the current residents and community.

mid apartments - romulus, mi

The Mid Apartments is group of three buildings located near Detroit Metro Airport in Romulus, MI. The portfolio features 24 apartments. Our strategy is to minimize turnover costs while increasing rents through our existing relationships with the current residents and community and target Airport District Employers to retain quality occupants.

north detroit street - toledo, oh

The North Detroit Street apartment building is located within 6 miles of in the University of Toledo in Toledo, Ohio. The portfolio features 24 apartments. Our strategy is to minimize turnover costs while increasing rents through our existing relationships with the current residents.