|

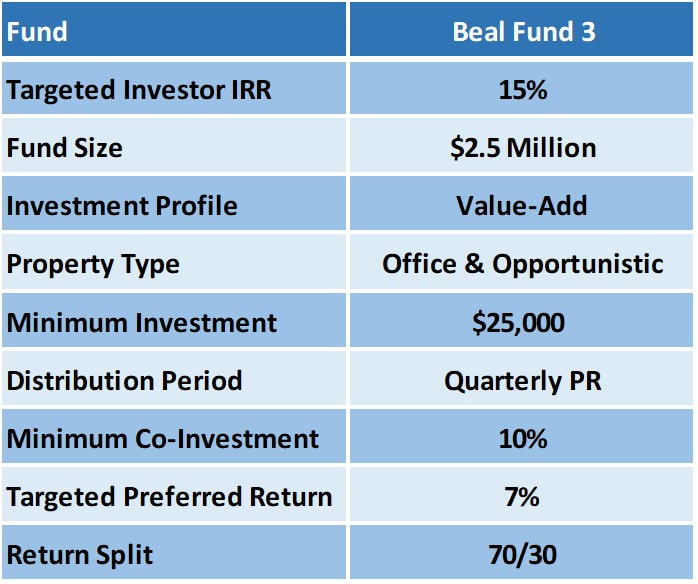

Beal Fund III LP, a Delaware limited partnership, has been formed to invest in opportunistic commercial real estate and office assets in Michigan and Ohio. The fund will focus primarily on cash-flow positive office assets in Southeast Michigan with flexible uses.

Beal Capital will create value by implementing capital improvements plans, creating operation efficiencies, increasing occupancy, and reducing operational expenses. The portfolio is expected to benefit greatly from economies of scale through aggregation. |